On the evening of Wednesday, February 8th, the House of Commons authorised the UK government to trigger Article 50 and begin the negotiation process for Britain to leave the EU. However, the bill still needs to be approved by the House of Lords, and many of its members remain steadfastly opposed to Brexit.

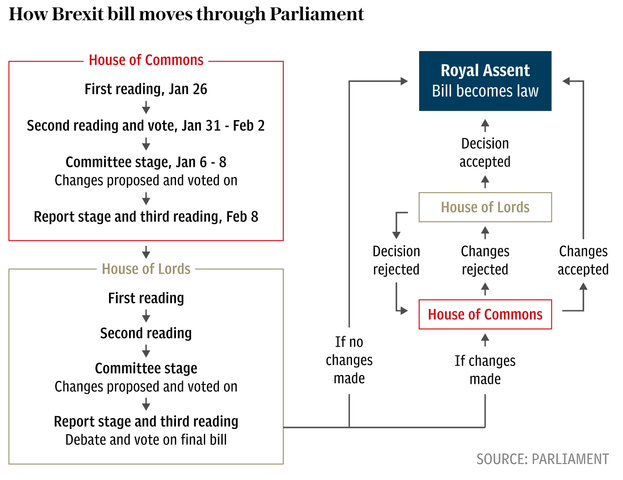

Image 1: How Brexit bill moves through Parliament

Article 50 of the Treaty of Lisbon authorizes a member of the European Union to leave the EU after a 2-year period of negotiations. March 31st, 2017 is the deadline that Prime Minister Theresa May has set to start the process. Below are some of the consequences of a “divorce from the European Union” that investors should consider in order to weigh the impact they might have on the different asset classes.

The First Concrete Consequences of BREXIT

#1 Years of negotiation ahead with Britain’s main trading partners

Leaving the European Union cannot be done overnight. If no agreement is reached within the stipulated 2-year negotiation period, the UK’s membership in the European Union will automatically end, unless the European Council and the UK decide together to extend it.

In order to activate Article 50, a withdrawal agreement needs to be settled and must describe “the arrangements for withdrawal, taking account of the framework for the UK’s future relationship with the Union.” On the agenda are the rights of European citizens living in the UK, cross-border security arrangements, the closure and relocation of European agencies based in the UK, and more.

#2 It is becoming harder for British entrepreneurs to hire European workers

As mentioned in our previous analysis, Prime Minister May has stated that she wants to “prioritize immigration control over access to the European Single Market”. Since freedom of movement within the EU is one of the fundamental “four freedoms” of the continental bloc, this would make a “hard Brexit” – a clean break with the EU – much more likely to happen.

Uncertainties about the future agreement between the UK and the EU are increasing, which seems to be encouraging European workers to leave Britain and head back to mainland Europe. Last week, the Chartered Institute of Personnel and Development (CIPD) published a study showing that British managers are finding it more difficult to hire EU citizens, especially in low-skilled sectors such as sales, hospitality, and catering.

#3 Higher financial instability

Seeing the world’s 5th most powerful economy leave the European bloc will have a major impact on the markets. While London could well retain its position as Europe’s financial capital, the EU has indicated that it wishes Frankfurt to assume the mantle.

UBS has also suggested that Dublin, Amsterdam, Paris or Luxembourg City could also become the preeminent banking and financial services center of the EU.

#4 The UK could become less attractive to foreign investors

Many global companies currently use the UK as a gateway to Europe, and some have already decided to relocate their European headquarters in the case of a “hard Brexit”. Several large banks and insurance companies have already moved some of their workforce outside of Britain, or have plans to do so.

Thanks to the European passport, those companies have direct access to the EU’s financial markets. As Brexit is likely to take away London’s role of gateway to the European Union, investors could be less interested in investing in the UK, and direct foreign investment could diminish.

For more on UFX’s tradeable assets, make sure to visit our assets page.

UFX was founded in 2007 and has grown into a leader in the online trading industry. The company is fully licensed and regulated and holds traders’ privacy and security to the highest standard. It’s easy to sign up for an account with UFX and even easier to start trading. Whether you’re a novice trader or experienced in the industry, UFX has all the tools you’ll need to get started.