Last Friday, Gold finished trading with its best weekly gain in 7 months. The precious metal went on to reach its highest level since the beginning of November 2016, as market participants reduced their bets on future rate hikes. Last Friday, the 1st NFP report of 2017 showed far more jobs that were created in January than previously thought (227,000 as opposed to 170,000), while the unemployment rate increased slightly to 4.8%. The report also indicated weaker wage growth, suggesting a lack of inflationary pressures.

Last Friday, Gold finished trading with its best weekly gain in 7 months. The precious metal went on to reach its highest level since the beginning of November 2016, as market participants reduced their bets on future rate hikes. Last Friday, the 1st NFP report of 2017 showed far more jobs that were created in January than previously thought (227,000 as opposed to 170,000), while the unemployment rate increased slightly to 4.8%. The report also indicated weaker wage growth, suggesting a lack of inflationary pressures.

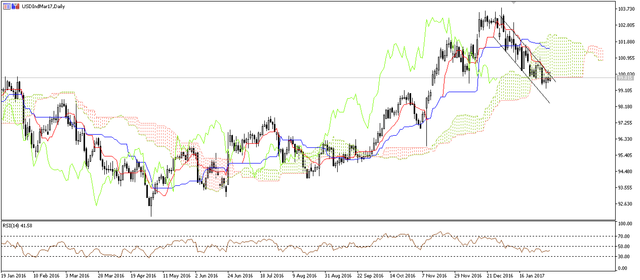

Gold Prices Up to 3-Month High

Image 1: Gold – Daily

Gradual Rate Hikes to be Expected

Last week, the FOMC decided to leave its monetary policy unchanged, with the federal funds rate remaining in the 0.50 – 0.75% range. Federal Reserve Board members noted that investors should expect “gradual increases in the federal funds rate,” which should stay low “in the long run.”

Chicago Federal Reserve Bank President and CEO, Charles L. Evans, delivered a low rate-focused speech last week at the Prairie State College Economic Breakfast in Olympia Fields, Illinois. He said: “I believe that appropriate policy calls for a slow pace of normalization in order to give the real economy an adequate growth buffer to withstand downside shocks that might otherwise drive us back to the zero-lower-bound.”

After raising rates for the 1st time in 10 years in December 2015, the Fed had anticipated 4 rate increases in 2016. However, global economic and political uncertainty, combined with high market volatility, caused sufficient uncertainty for the Fed to reconsider.

With minimal wage inflation across the US, and uncertainty about the new administration’s decisions on growth, employment, and inflation, the next rate hike might not be imminent. In December, however, FOMC members announced that rates would likely rise 3 times in 2017.

Weak Wage Inflation

The Fed has a dual mandate of full employment (a target of 4.8% for the unemployment rate) and price stability – the PCE price index should reach 2%. The last employment report was positive, but the weak point was wage growth, which is closely monitored by investors in order to predict future decisions by the Fed.

Uncertainty surrounding future interest rate increases is rising, as is doubt about the overall impact of fiscal stimulus policies. Such anxieties can drive investors towards safe-haven assets, boosting the price of precious metals.

One possible reason for this is that all decisions made by a central bank influence the cost and availability of that economy’s monetary holdings, directly impacting currency supply and demand in the foreign exchange market. Commodity prices and the USD have a negative correlation: when the USD goes up, commodity prices tend to go down, and vice versa.

When a country’s interest rate rises, this attracts foreign investors, as demand for the national currency increases relative to other currencies. Higher interest rates also increase borrowing costs, reducing the amount of money in the markets, further boosting the value of the relevant currency.

When investors are unsure when subsequent rate hikes will occur, the value of the US Dollar tends to fall, which drives commodity prices upward. This process happens independently of the fundamental factors driving supply and demand.

Gold is a safe-haven asset often bought in times of high market volatility and economic uncertainty. It’s worth noting, however, that in the past, when Gold and Bond yields simultaneously increased in value, the markets had been on the verge of a major correction. This could be something to watch out for as traders plan their Gold trading strategies.

For more on UFX’s tradeable assets, make sure to visit our assets page.

UFX was founded in 2007 and has grown into a leader in the online trading industry. The company is fully licensed and regulated and holds traders’ privacy and security to the highest standard. It’s easy to sign up for an account with UFX and even easier to start trading. Whether you’re a novice trader or experienced in the industry, UFX has all the tools you’ll need to get started.